Monthly premium: Paying a monthly premium is the most common PMI option. The most common PMI payment methods include: Others require you to agree to a specific option. Some lenders may let you choose a payment method. There are a few ways to handle PMI payments. Instead, your lender charges you for it automatically. That means you don't have to worry about remembering an extra payment or providing proof of PMI. If you have to pay PMI, your lender will set up the payment and coverage, connecting the PMI directly to your loan. PMI rates may vary among lenders and mortgage types. Instead, lenders arrange PMI directly with their provider of choice, so you don't have to take any additional steps. If your LTV is over 80%, you may need PMI.Īs the buyer, you don't choose your PMI provider. You can calculate your LTV ratio by dividing your new mortgage amount by the market value of your home. If you're refinancing your current mortgage, most conventional lenders require an LTV ratio of 80% or less to avoid having to pay for PMI. For refinance loans, your loan-to-value ratio is over 80%. If you can't afford to put down at least 20% on a purchase, you may have to pay for PMI. You can calculate your down payment percentage by dividing the amount you plan to put down by the lesser of the market value or purchase price of the home. Most conventional lenders require a down payment of at least 20% of the purchase price. Lenders may require PMI on certain loans if: You may have to pay for PMI if you're purchasing a house or refinancing your mortgage. However, PMI does offer some benefits to you as the borrower. Paying PMI may help qualify you for a conventional loan that you wouldn't be eligible for under other circumstances. If you default on your mortgage, PMI pays part of the remaining balance of the loan to the lender.

However, PMI can help lower the risk that some mortgages bring.Īlthough you pay for PMI as the borrower, this insurance doesn't protect you. Lenders always accept some level of risk with mortgages. PMI is a type of insurance that lenders require for certain mortgages with high LTV ratios.

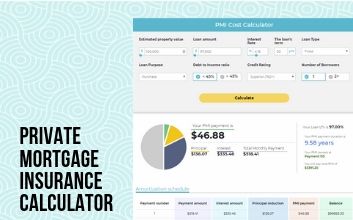

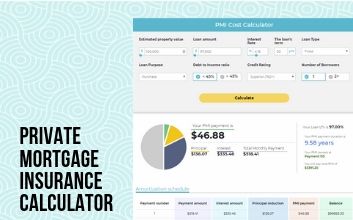

#Mortgage calculator pmi how to

Find out when you have to pay PMI and learn how to calculate the cost. When do you have to pay private mortgage insurance (PMI) and how much will it cost you? It depends on your loan-to-value (LTV) ratio. When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance – private mortgage insurance.

0 kommentar(er)

0 kommentar(er)